Real estate assets provide significant financial benefits through strategic tax deductions. Most property owners overlook substantial savings due to simple administrative errors. Proper documentation ensures that every eligible item contributes to a healthy bottom line. Accurate reports reflect the true value of assets and help maintain compliance with national standards. This article explores common mistakes that lead to missed opportunities for investors on the Sunshine Coast.

Critical Asset Identification Errors

Investors frequently miss out on deductions because they fail to identify all depreciable assets within a property. Specialists in Tax Depreciation Sunshine Coast provide the necessary expertise to categorise every fixture and structural component correctly. These professionals identify plant and equipment items that standard accountants might overlook during a basic review.

A comprehensive report captures the value of carpets, blinds, and air conditioning units across the Sunshine Coast. Precise data entry prevents the loss of thousands of dollars over the life of an investment. Every asset requires a specific rate of decline to meet regulatory requirements.

Failure to Account for Previous Renovations

Many owners assume that only new buildings qualify for significant tax benefits. Older properties on the Sunshine Coast contain hidden value through past renovations or structural improvements. These upgrades provide substantial deductions even if a different owner completed the work years ago.

A qualified surveyor uncovers these additions and calculates their current worth for the tax report. Neglecting these historical improvements results in a smaller refund each year. Investors must verify the age and cost of all previous work to maximise their claims.

Delayed Report Commencement

Owners sometimes wait until the end of the tax year to organise their paperwork. This delay causes stress and might lead to rushed, inaccurate data collection. Immediate action after a property settlement allows for the most accurate capture of the asset condition and ensures that depreciation reports for rental properties reflect the property’s true value from day one.

A prompt inspection ensures that the surveyor sees the property exactly as it was at the time of purchase. Early reports also allow for better cash flow management throughout the financial year, as investors can rely on precise depreciation reports for rental properties when planning tax strategies. Promptness guarantees that the investor receives the full benefit of the claim from the very first day.

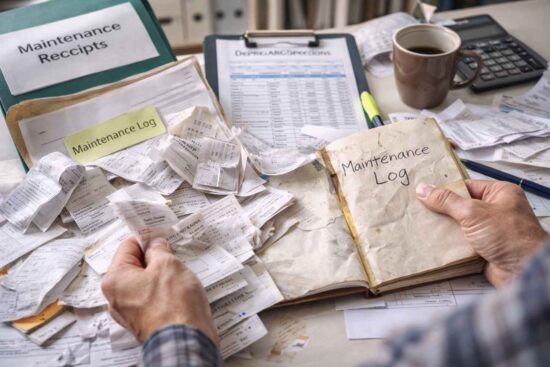

Inconsistent Record Maintenance

Success in real estate requires a meticulous approach to record keep. Many investors lose track of small upgrades or replacements that occur during a tenancy. These small items add up to significant deductions over several years. A centralised file for all property-related expenses keeps the depreciation schedule up to date. Consistent updates prevent the need for costly retrospective adjustments to previous tax returns. Systematic habits ensure that no deduction remains unclaimed on the Sunshine Coast.

Avoidance of Professional Advice

The tax system contains specific rules that change over time. Reliance on outdated information leads to missed opportunities or incorrect claims. Professional advisors stay current with every legislative shift to protect the interests of their clients. They provide a bridge between complex tax laws and practical property management. Small fees for professional services usually pay for themselves through increased tax refunds. Experts provide the most reliable path to financial efficiency for every property on the Sunshine Coast.

Maximise the potential of every investment by securing a professional Tax Depreciation in Sunshine Coast report immediately after purchase. This strategy ensures that every structural element and fixture contributes to annual tax savings. Maintain a detailed log of all maintenance and improvements to capture every possible deduction. Expertly prepared schedules provide a clear roadmap for long-term wealth creation. Accurate claims transform a standard property into a high-performing financial asset for years.